As a first time buyer, such a big purchase can be VERY daunting. We want to help to take away the stress and make it just as exciting as it should be! You’re buying your very first home! We have put together a little guide and highlighted a few things that you should think about along the way.

Check your budget. The last thing that you want is to fall in love with a property to learn that it is just out of reach. It is important to get financial advice from a qualified financial advisor who will be able to assess your personal situation. You will also need to factor in additional costs such as legal costs (Click here to get a conveyancing quote from Gent Law), stamp duty (check here using our Stamp Duty Calculator) and removal costs.

Stamp Duty Calculator

You may be looking at using gifted deposits from mum and dad or Government approved schemes such as Help to Buy. All of these things could seem fairly straight forward but before you go ahead and offer on a property, it really is worth speaking to a financial advisor to discuss your personal situation. They will then be able to guide you in the right direction on which route to go down. With so many options available, there might be more at your fingertips than you initially thought.

It is important to put together a list of wants and needs. From the outset, there are certain things that you will NEED from a property and certain things that you will WANT. Distinguishing the difference in these will help you to formulate a list of important factors for your new home. Think about where you need to be, what you need in regards to rooms and how the space needs to be configured and also whether you want to do anything to the property and if finances can stretch to work that may need doing. Once you have this list together you can register with agents and start to set up alerts on all of the major portals.

It is important to start your search with an open mind and look at the types of property you can afford which will help you understand if your list of wants and needs is realistic but remember your agent is a professional so ask them for advice. Most agents now offer virtual viewings to make this process easy but there is nothing like a physical viewing of a house, so after you have done your research, get in touch with the marketing agent and book in a viewing. Let the agent know that you are a first time buyer, they will be able to guide you through the process and answer any questions that you have.

It is important to think carefully about what you want to offer on a house. Speak to your agent, they will be able to advise you on the factors which may influence the vendor.

When making your offer, be careful not to offend the seller. Make informed decisions on how much to offer by comparing this property to others in the area that have sold. Be fair when making your comparisons and offer what the property is worth to you.

Make sure that you know your position in regards to funding and can clearly put that forward as part of your offer, a ready and able buyer can be very appealing to a seller. As a First Time Buyer, you take away the risk of the chain, but it is wise to make the agent clear that you have done your research in regards to finances and are ready to buy.

All the negotiating has been done, it’s time to start the legal process. Your agent will need you to confirm some details regarding ID, solicitors and Proof of Funding in order for them to issue a Memorandum of Sale to all parties, confirming the details of the transaction. If you need an idea on conveyancing costs click here.

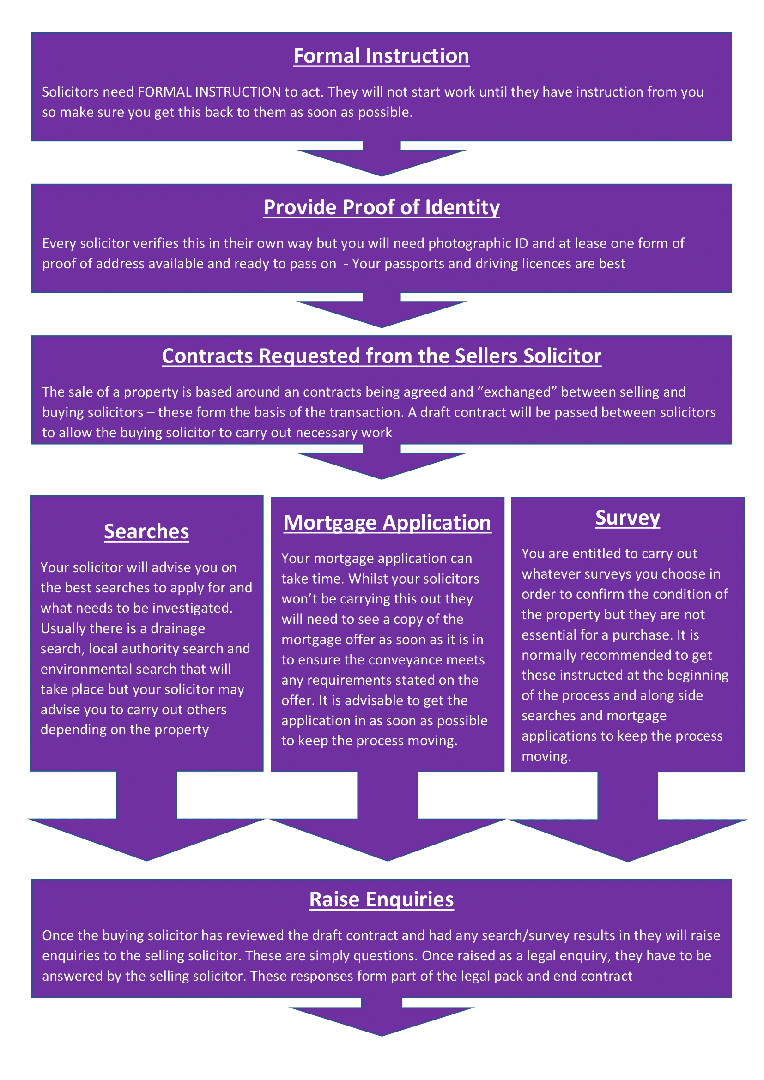

Once the memorandum of sale has been issued, the solicitors will begin the conveyancing process to ensure there are no surprises with what you are buying and to make sure you’re aware of all of your legal obligations. The agent’s role in this is to ensure that all parties know where the transaction is up to and to keep the whole chain moving along together.

If there is a mortgage involved in your purchase, this is where your application process will also begin so get back in touch with your financial advisor and be ready to provide them with all of the information that they need. If you are using Help to Buy or gifts from mum and dad, the agent and solicitors will need to see the information surrounding this as well so have it ready.

If you are having a mortgage, your mortgage company will arrange a mortgage valuation but depending on the type of property you are buying, you may want a professional to take a look. Whether it is a builder who you trust to give you an idea on costs of works that you want to carry out or you choose to go for a full survey, speak to your agent to discuss the options and which route is advisable to go down. You don’t want to spend money on unnecessary surveys if the information is already available.

This is where your completion date will be confirmed and you will pay the deposit agreed to the solicitors. You are now legally bound to this property. You will also need to have organised your removals. You can also look at organising your utilities etc.

Get those boxes packed and ready to move to your new home. The solicitors will now transfer funds through the chain starting from the bottom and all of the way up to your new house. As soon as funds have landed with the sellers solicitors, they will call to inform both the seller and the agent that the keys are to be released to the buyer! You’ve successfully made it and now the legal owner of your new home! Congratulations.

Your solicitors will do all of the legal work on Land Registry to make sure your new home is correctly registered, however it is your responsibility to register with utilities, doctors, schools and the bank as well and updating any identification documents. Visit our How To Section where there is a useful checklist to make sure you don’t miss anything.

Explore helpful articles

Browse the properties that we currently have available on the market – your first home might be hidden away in the list!

It is important to get some advice on your mortgage – Our calculator can help to provide an idea on affordability.

The conveyancing process can be complicated – we can help with some guidance and quotes from Gent Law.